are assisted living facility fees tax deductible

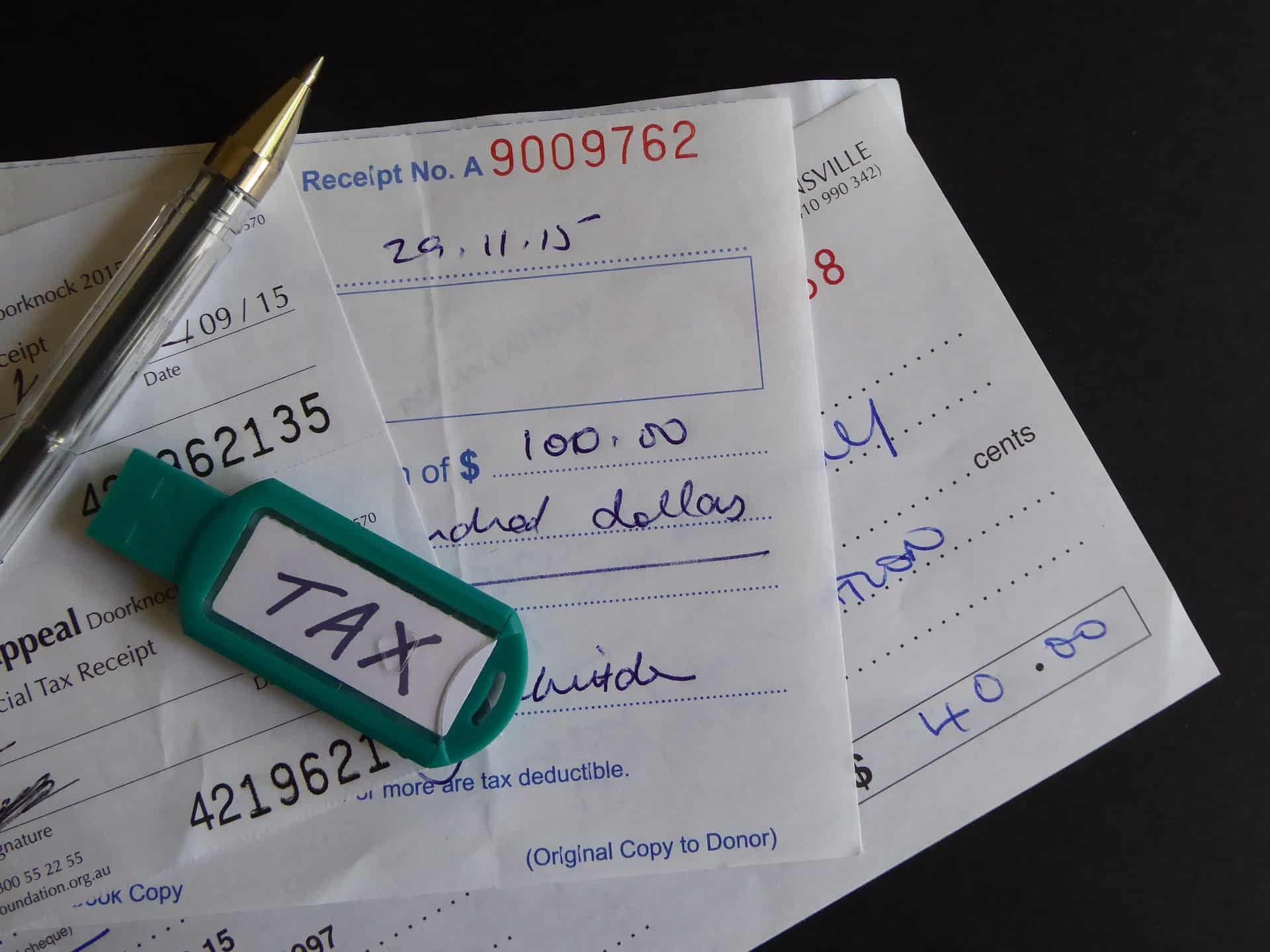

Deducting Assisted Living Expenses Long-term care services are tax-deductible expenses on Schedule A according to the 1996 Health Insurance Portability Accountability Act. There are certain expenses that are prohibited from being tax deductible.

Are Nursing Home Fees Tax Deductible In Canada Ictsd Org

They were 18 years of age or older.

. Answer Yes in certain instances nursing home expenses are deductible medical expenses. The Health Insurance Portability and Accountability Act also known as HIPPA directs that qualified long. Simply add up the.

75 of your income is 7500 so you. Medical expenses including some long-term care expenses are deductible if. Are long-term insurance premiums eligible for deduction.

But did you know some of those costs may be tax deductible. To return to Moms and Dads situation above they have 48600 of medical expenses the assisted living facility costs and the unreimbursed drug expenses. Your qualified long-term care insurance premium payments are deductible if theyre.

YOU must do the math yourself. For example if your medical expenses are 10000 and your annual income is 100000 you could only deduct 2500 from your taxes. Any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes and you can only claim care expenses that you paid.

Are Assisted Living Expenses Tax Deductible In 2021. But did you know some of those costs may be tax deductible. They were not your spouse or common-law partner.

If you or a family member lives in an assisted living facility you know that assisted living costs continue to rise every year. Are Assisted Living Facility Cost and Expenses Tax Deductible. If a personal aide provided qualified long-term care.

There is no IRS form or worksheet in the TT program. If you or a family member lives in an assisted living facility you know that assisted living costs continue to rise every year. As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible.

If you your spouse or your dependent is in a nursing home primarily for medical. But did you know some of those costs may be. TurboTax also notes that assisted living expenses can be tax deductible for individuals needing supervision because of cognitive impairment such as dementia or.

You can claim amounts paid to an attendant only if the attendant met both of the following criteria. Tax Deductions For Assisted Living Most assisted living facilities report the. Most assisted living facilities charge a single rate which includes expenses for services that are potentially deductible.

The assisted living facility should provide residents with a statement showing what part of their fees is for medical costs. So if it costs 60000 per year for the facility and the letter tells you 50 is for. To deduct certain medical expenses an assisted living resident must meet the following criteria.

If you or a family member lives in an assisted living facility you know that assisted living costs continue to rise every year. For example housing fees are not tax deductible unless your loved one resides in an assisted living. In the case of an assisted living community your loved one or an appropriate relative may qualify for a medical expense.

In preparation for his income tax return for 2021 I am not clear as to whether the full cost at the facility is tax deductible under medical expenses or if only a portion is.

Are Assisted Living Costs Tax Deductible Ask After55 Com

Is Assisted Living A Tax Deductible Expense Carepatrol Blog

Are Nursing Home Expenses Tax Deductible In Canada Ictsd Org

Is Senior Home Care Tax Deductible

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Are Assisted Living Expenses Tax Deductible Andrew J Chamberlain Law Specialist

Is Assisted Living Tax Deductible Medicare Life Health

What Tax Deductions Are Available For Assisted Living Expenses

Is There A Tax Deduction For Memory Care Facility Costs A Place For Mom

Tax Deductions For Assisted Living

Are Assisted Living Expenses Tax Deductible Medical Expense Info

Are Assisted Living Expenses Tax Deductible In Canada Ictsd Org

Are Nursing Home Costs Tax Deductible Canada Ictsd Org

Can I Get Tax Deductions From Assisted Living Expenses

Tax Deductions For Assisted Living The Arbors Assisted Living Community

Are Assisted Living Costs Tax Deductible Ask After55 Com

Are Assisted Living Expenses Tax Deductible Medical Expense Info